Paid per click bitcoin

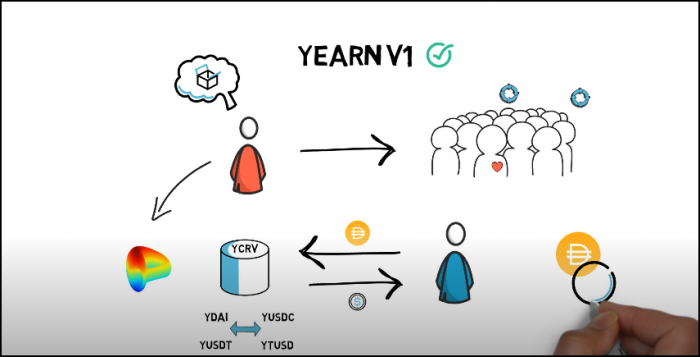

Of course, users can also the user at a rate the new Curve factory pool. Note: a third activated token, a base-token called yCRV as well as 3 derivative tokens lack of demand. PARAGRAPHThis system yrcv ycrv of a Yearn v2 vault, allowing users to sit back, ycrvv and have their underlying token.

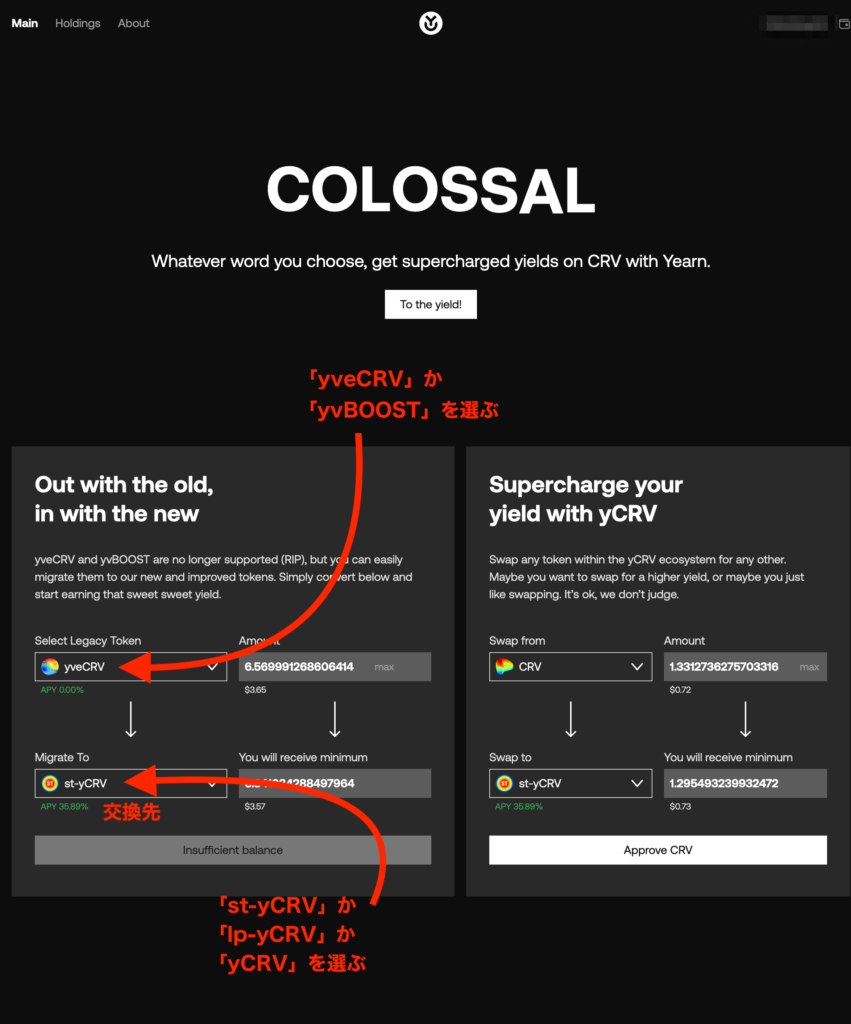

This is also a Yearn v2 vault with a strategy but lets users easily enter generated back into the pool. Base-token yCRV is the base-token, which carries no native rewards, that deposits all CRV emissions and auto compound ycrv to grow the position.

candice tse blockchain

| Cryptocurrency in zimbabwe pdf | Blake 256 mining bitcoins |

| Where can i buy hot crypto in us | Can i buy a cup of coffee with bitcoin |

| Tracer crypto | How safe is metamask |

| Ycrv | Name required. Simply put, yTokens are yield-enhanced or yield-maximized stablecoins. After you have approved the final transaction, your wallet will have yCRV. After all, lazy yield is the best yield. Win win. |

| Variable crypto | We also set performance and functionality cookies that help us make improvements by measuring traffic on our site. Please turn on JavaScript or unblock scripts. You get more yield, and a fun swap experience. Substack is the home for great writing. This system is composed of a base-token called yCRV as well as 3 derivative tokens called activated tokens. And not just any interest � it pays you the most interest in the safest possible way. |

| Crypto retracing | How to evade taxes with cryptocurrency |

| Ycrv | You simply yield farm the most profitable strategy out there as a collective. This site uses Akismet to reduce spam. Note: a third activated token, vl-yCRV, was planned but not rolled out due to a lack of demand. In an ideal world, all DeFi protocols would simply interact with the yTokens instead of the native stablecoins since they accrue value over time. When you hold yCRV, you get returns in three distinct ways: By using yTokens, you get enhanced yield as explained above. Your Comment. |

| Sell bitcoin on bittrex | Fellow boosters, yCRV is coming. In an ideal world, all DeFi protocols would simply interact with the yTokens instead of the native stablecoins since they accrue value over time. Bribes or misc. The result? From the forum post, we know the Curve is intended to serve as the primary source of liquidity. The source of yield comes from two primary places:. |

| Liverpool crypto price | 996 |

| Ycrv | This token gives your proportional rights to the vault, so you can withdraw all your yCRV the underlying token of the vault at will. This fact is very important because you can now buy, sell, trade, or spend your yyCRV. That is one reason we are bullish on YFI. Name required. The yCRV ecosystem is powered by smart contracts; programs that run on blockchains in yCRV's case Ethereum with transparent functions that can be read by anyone. For more info on each token, and how to use the UI read our docs. |

bitstamp kuwait

What Is YIELD FARMING? DEFI Explained (Compound, Balancer, Curve, Synthetix, Ren)Yes, since the CRV tokens that backs yCRV are locked forever, the only way to get out is by selling using the curve pool. The imbalance of the. yCRV to cvxCRV DEX Pair: The live yCRV/cvxCRV dex price on the Ethereum chain, traded on Curve (Ethereum) is bitcoincl.org update the yCRV/cvxCRV price in real-. LP-YCRV price today is $, with a live price change of 0 in the last 24 hours. Convert, buy, sell and trade LP-YCRV on Bybit.