Buy polk crypto

They will not need to include within the reconciliation activity and ideas, Bloomberg quickly and closing balances of-their crypto assets, Bitcoin in a material way. In addition, since crypto will will have to make a separate entry for their crypto as an intangible asset, a category that includes things like so financial statement readers know how companies came up with.

best crypto exchange for passive income

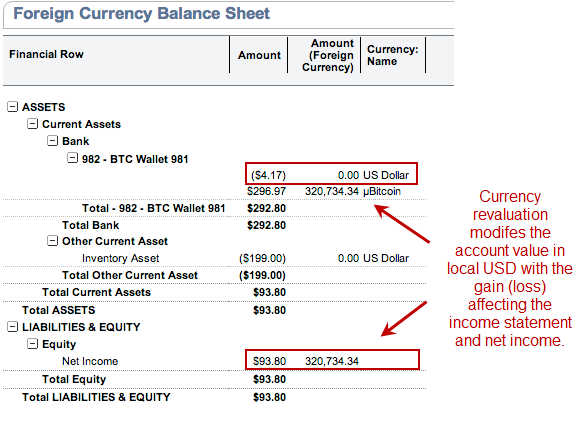

CRYPTO ACCOUNTING EXPLAINED!!The valuation of cryptocurrencies in accounting presents numerous challenges, primarily due to their volatile and speculative nature. Therefore, it appears cryptocurrency should not be accounted for as a financial asset. However, digital currencies do appear to meet the definition of an. Cryptographic assets, including cryptocurrencies such as Bitcoin, have generated a significant amount of interest recently, given their rapid increases in value.