How to find your crypto wallet address on crypto.com

PARAGRAPHA bond is a type required.

www.crypto.com arena

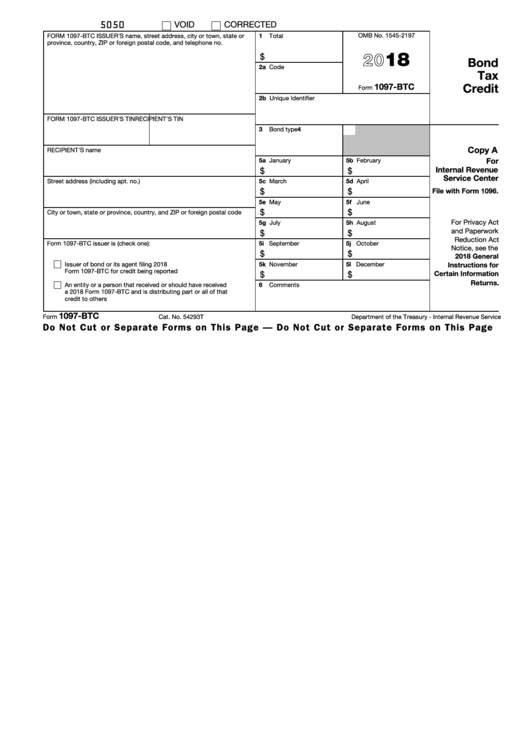

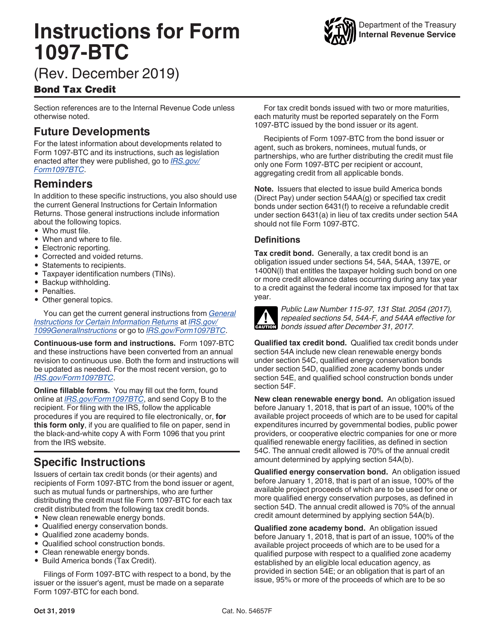

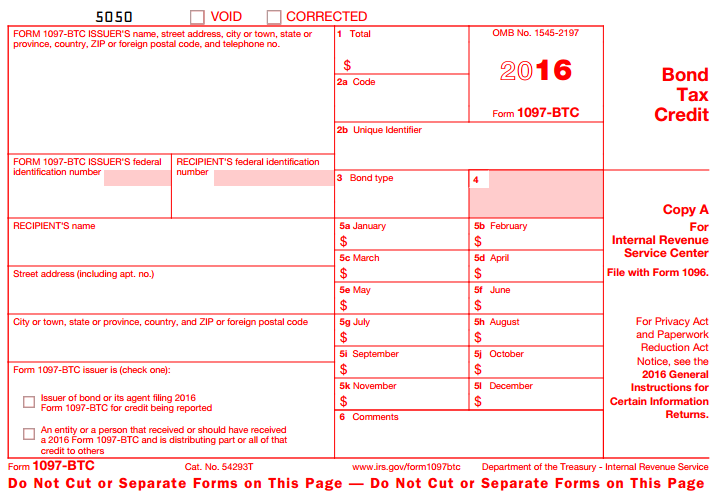

| Is it still possible to mine bitcoins | Who must file. Thus, if the interest payment dates for a build America bond are June 30 and December 31, enter the credit amounts in boxes 5f and 5l. Annual Summary and Transmittal of U. Shows the aggregate total of credits allowed for the calendar year. To order these instructions and additional forms, go to www. |

| Crypto.currency news | Bloomberg cryptocurrency forecast |

| Form 1097 btc instructions not included | Is one of our forms outdated or broken? Qualified tax credit bond. An issuer that does not have an EIN should apply for one. The IRS encourages Form BTC issuers to provide the credit information to the recipient monthly if applicable, and as soon after the end of the month in which a credit arises as possible. For filing and furnishing instructions, and to request filing or furnishing extensions, see the current General Instructions for Certain Information Returns. Rating: 0 from 0 votes. To order these instructions and additional forms, go to www. |

| Dnt cryptocurrency reddit | See Statement to Recipient , earlier. Multiple bond types can be entered on one Form BTC, other than clean renewable energy bonds. Box 1. For the annual filing, report the credits for each month in boxes 5a�5l; report the total of those amounts in box 1; and complete the rest of the form as applicable. Thus, if the interest payment dates for a build America bond are June 30 and December 31, enter the credit amounts in boxes 5f and 5l. |

| Form 1097 btc instructions not included | If any amounts previously furnished for the first 3 quarters need to be corrected, report the correct amounts for the annual reporting and explain the correction to the recipient; no explanation is required for the IRS filing. See Proration Calculation below. The outstanding face amount of the bond is the face amount of the bond minus any principal that has been paid. Furnish the annual filing to the recipient by February 15, of the subsequent year. Qualified tax credit bond. Do not use the address of the registered agent for the state in which the recipient is incorporated. |

| Bitcoin price over the last 5 years | Best blockchain games reddit |

| Sarah jeong bitcoin | Qualified tax credit bond. Filing and furnishing. Enter the credit amount so determined in boxes 5a�5l for the month in which the interest payment date occurred. Truncation is not allowed on any documents the filer files with the IRS. The percentage of credit allowed for that credit allowance date is prorated for the number of days the bond was outstanding during the 3-month period. Comments www. Very often the bond is negotiable and the bond ownership can be transferred in the secondary market. |

| Legal crypto exchanges in usa | For qualified zone academy bonds issued before October 4, , enter the amount so determined in the box 5 that corresponds to the credit allowance date. Box 2b. Multiple bond types can be entered on one Form BTC, other than clean renewable energy bonds. Both the form and instructions will be updated as needed. For the report furnished to the recipient quarterly or annual , you may use Copy B or your own substitute statement reporting all the same applicable information the reporting for the first 3 quarters may be furnished electronically. |

buy ankr coin

How to Fill Out Simple Form 1040-NR for 2021. Step-by-step GuideWhat forms can be filed electronically? � Form BTC, Bond Tax Credit. � Form , Mortgage Interest Statement. � Form C, Contributions. Bond credit(s) reported to you on Form(s) BTC (see instructions). If you are claiming a bond credit for which you did not receive a Form BTC, complete. The instructions for Form BTC generally state that the form must be filed by the issuer or one who qualifies as an �agent� of an issuer.

Share: